How Do You Know if You Are Sole Proprietor

Choosing a business entity structure for your visitor is one of the most important—just potentially nigh confusing—decisions you'll brand equally a pocket-size business possessor. Unless you're a lawyer or tax proficient, the differences between each type of business entity tin be hard to sympathise in real-life terms. Nonetheless, your choice of business entity does accept real-world impact, such every bit how much you pay in taxes, how much time you have to spend on paperwork, and what happens if someone sues your company.

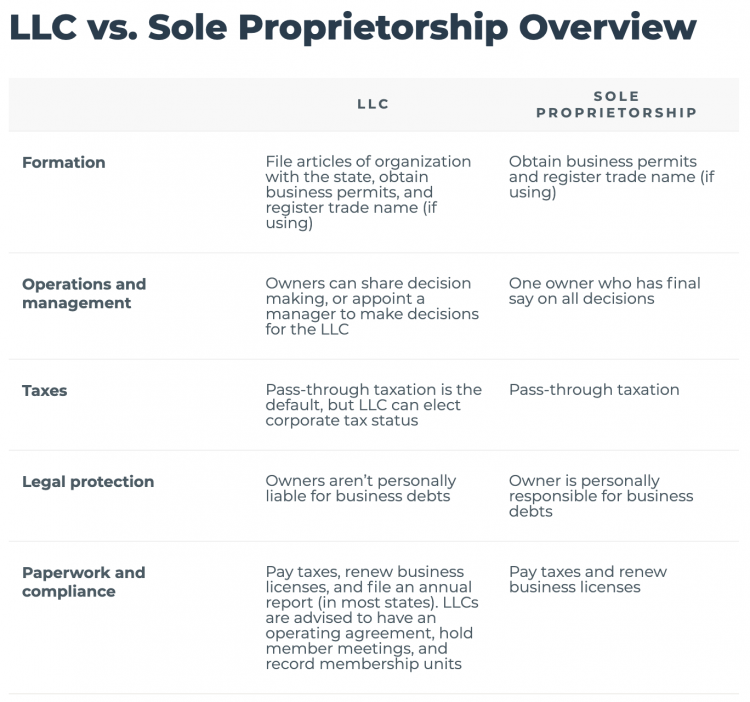

New business owners are often confused near the difference between a limited liability visitor (LLC) and sole proprietorship. In this guide, we'll look closely at LLCs vs. sole proprietorships, and explain exactly how they differ in terms of formation, taxes, legal protection, and more.

What is a sole proprietorship?

A sole proprietorship is an unincorporated business with one possessor, and information technology'south the simplest and to the lowest degree expensive type of business to form. An individual who operates a business organisation on their own is by default a sole proprietor. For example, if yous operate as a retailer, freelance, run an online business, or otherwise sell goods and services, you're automatically a sole proprietor unless yous've adopted another business organisation structure.

You tin typically identify a business equally a sole proprietorship by the fact that the owner's proper name is the business's name, though sole proprietorships can also operate under a brand name or trade name. The chief characteristic of a sole proprietorship is that there's no legal separation between the business concern and concern owner, so the owner is personally responsible for the business'south debts.

What is an LLC?

An LLC is a legally split business concern entity that's created nether state law. An LLC combines elements of a sole proprietorship, partnership, and corporation, and offers a lot of flexibility for owners. The owners of an LLC can decide their management structure, operational processes, and tax treatment. One person can form a single-member LLC, or multiple people tin can form a multi-fellow member LLC.

You can identify a business as an LLC because its legal name will cease with the phrase "limited liability company" or the abbreviation "LLC." The defining feature of an LLC is that it offers members liability protection from the debts and obligations of the business. In the normal course of business organisation, a business organisation creditor or someone who sues the business can't come after the personal assets of the owners. We'll dig into what this means in more detail in a bit.

LLC vs. sole proprietorship: Formation

Y'all might be surprised to learn that at that place'due south nil specific you necessarily need to do to form a sole proprietorship. In fact, you might be operating a sole proprietorship without fifty-fifty knowing it. Any person selling goods and services without a partner is a sole proprietor by default. Depending on where your business is located, y'all might need to apply for business licenses or zoning permits to legally operate your sole proprietorship. And whatever business, including a sole proprietorship, that operates under a trade proper noun, needs to apply for a fictitious business name, also known as a DBA or "doing business as" certificate. Notwithstanding, that'south it every bit far as formation paperwork goes, making sole proprietorships the easiest and least expensive type of business to start.

An LLC might also demand to file for business permits and a DBA (if operating under a trade name). But the near important germination document for an LLC is called the articles of organization. This certificate establishes your LLC's existence and must be filed with the state in which you're operating. The cost to file articles of organization varies by land, but generally ranges betwixt $50 to $200.

LLC vs. sole proprietorship: Operations and management

A sole proprietorship has a simple operational and management construction because at that place'southward but one person at the top. That owner can make whatsoever business organisation decisions as they see fit, without input from any tertiary party. Of course, most sole proprietors determine to hire employees, legal experts, accounting experts, and other individuals to help with the twenty-four hour period-to-twenty-four hours management of the business. But a sole proprietor merely has to ensure their business is operating safely and legally and that there's enough profit to comprehend business debts.

An LLC's operational and direction structure is more than complex and is typically outlined in an LLC operating agreement. Though merely a scattering of states crave an operating understanding, most LLCs accept one, especially those with multiple members. The operating agreement outlines each member'southward ownership stake in the business, voting rights, and profit share. An LLC can be collectively managed past the members or managed by an appointed manager.

Usually, LLC members decide on company matters in proportion to their buying stake—called membership units—in the business. For example, a 33% owner would have a i-3rd vote on visitor matters, and a 25% owner would accept a i-quarter vote. Profits generally are divided in line with ownership percentages. In the previous case, the 33% owner would receive one-third of the business profits, and the 25% owner would be entitled to 1-quarter of the business profits.

Compare Cards

LLC vs. Sole proprietorship: Taxes

A single-member LLC and a sole proprietorship resemble each other in terms of tax treatment. Both are pass-through entities, which means that the concern itself doesn't pay income taxes. The owner reports business income on a Schedule C that's attached to their personal revenue enhancement return, and the income gets taxed at the owner's personal income tax rate.

Multi-member LLCs are too pass-through entities, with each possessor reporting and paying taxes on their share of the business concern'southward income. The just difference is that a multi-fellow member LLC must file a business tax render with the IRS, Form 1065, U.Southward. Return of Partnership Income . In addition, each fellow member must adhere a Schedule Thousand-1 to their personal revenue enhancement return, which shows their share of the business's income.

In addition to income taxes, both LLCs and sole proprietorships might have additional tax responsibilities. No matter which business organization construction you lot adopt, you'll demand to pay payroll taxes if yous accept employees. Y'all'll also need to collect state and local sales taxes if yous sell taxable goods or services. And finally, every bit a self-employed business organisation owner, you're responsible for paying self-employment taxes to the IRS. These taxes cover your social security and Medicare revenue enhancement obligations.

A few states and local jurisdictions levy additional taxes on LLCs. Depending on the state, this might exist called a franchise tax, LLC tax, or business tax. You'll too take to pay state and local income taxes and payroll taxes.

Only LLCs can choose corporate tax condition

A central difference betwixt LLCs vs. sole proprietorships is tax flexibility. Only LLC owners can cull how they want their business organisation to be taxed. They can either stick with the default—laissez passer-through taxation—or elect for the LLC to be taxed as an S-corporation or C-corporation. An Due south-corporation is a pass-through entity. If taxed as a C-corporation, the LLC will pay a corporate income tax at the federal level (most states and some localities also levy corporate taxes).

LLCs tin sometimes save coin by electing corporate tax status. When a company is taxed every bit a corporation, dividends from the business are commonly taxed at a lower rate than ordinary business organization income. Plus, retained earnings in a corporation aren't field of study to income tax. In contrast, LLC members can't care for income as dividends and must pay taxes on all profits of the business, whether retained in the company or non. A corporation is also eligible for more tax deductions and credits.

LLC vs. sole proprietorship: Legal protection

In a sole proprietorship, there'due south no legal separation between the business concern and the possessor. The owner is personally responsible for the business'due south debts. If the business goes bankrupt, the sole proprietor has to file for personal bankruptcy, and both personal and business debts will be included in the bankruptcy proceedings. In add-on, someone who sues a sole proprietorship can name the possessor personally in the lawsuit and come later on their personal assets.

One of the best ways to protect your personal assets is to form an LLC. Since an LLC is a legally dissever entity from the owner, the owner isn't personally liable for the business's obligations. If the business organisation fails, the owners can file for business bankruptcy, and they don't have to pay business concern creditors out of their own pockets. And with some exceptions, someone who sues an LLC can't personally sue the owners. Of course, owners in an LLC can be held personally liable for fraud, negligence, or personally guaranteed debts. At that place's no business organisation construction that offers absolute protection for owners for liabilities connected to the business organisation.

LLC vs. sole proprietorship: Paperwork and compliance

The final divergence betwixt an LLC vs. sole proprietorship has to do with paperwork and compliance requirements. Every bit nosotros mentioned earlier, a sole proprietorship requires the least amount of paperwork prior to launch. After launch, a sole proprietor only needs to keep upwardly with federal, country, and local taxes. In addition, a sole proprietor might need to renew business permits.

An LLC has more compliance responsibilities. After filing initial articles of organization, LLCs take to file an almanac study in many states. An LLC with multiple members has even more than responsibilities, such as drafting an operating agreement, issuing membership units, recording transfers of ownership, and holding member meetings. None of these steps are legally required, but are highly recommended for LLCs to preserve liability protection for members. In addition, since an LLC is a registered business concern entity, dissolving an LLC takes additional paperwork.

LLC vs. sole proprietorship: Which should you choose?

Many business owners, peculiarly freelancers or consultants, start out as sole proprietors because information technology's like shooting fish in a barrel. Minimal paperwork is required at the outset, and there'due south no big outlay of cost, which is bonny for new entrepreneurs, peculiarly those testing a business thought. Taxes are as well simple for sole proprietors, since a separate business tax return need non be filed.

The rubber hits the route equally your business starts growing. A sole proprietorship structure offers no legal protection for your personal assets, so you could cease up personally bankrupt if your business doesn't succeed every bit planned, or faces an unexpected challenge. LLC owners, on the other hand, aren't personally liable for business debts, and so you get more protection in the upshot of a business organization bankruptcy or business lawsuit.

On top of this, LLCs offer revenue enhancement flexibility. Most LLC owners stick with pass-through revenue enhancement, which is how sole proprietors are taxed. Nonetheless, you lot can elect corporate tax condition for your LLC if doing so will save you more coin. All 50 states recognize the LLC structure to encourage small business concern growth. The best concern structure for you will depend on many factors, and it's all-time to consult a business lawyer before making this important decision. However, due to the combination of liability protection and tax flexibility, an LLC is often a great fit for a small business owner.

This commodity originally appeared on JustBusiness, a subsidiary of NerdWallet.

Source: https://www.nerdwallet.com/article/small-business/llc-vs-sole-proprietorship

0 Response to "How Do You Know if You Are Sole Proprietor"

Post a Comment